Following is a transcription of a chat session with Bank of America which outlines an attempt to have my fees reversed. Of course, I didn’t expect this to happen, though they did offer to refund $35 in fees.

What is most telling is how the customer service representative—both the front-line person and the specialist behind the lines—were not able to answer basic questions about the Clarity Statement, My Portfolio, the reason behind overcharge fees, the availibility of tutorials, how various screens on the site were interrelated, why certain monetary figures that could lead to overdraft charges appeared on different pages of the site, etc.

I have a hard time telling when I am speaking to an automated figure—the cut-and-paste element lends itself to that—or to a person. Especially annoying was when I was sent a link to a page I had already visited several times—or worse, to Janet!

This chat occurred on Tuesday, January 12, 2010, between the time of 5:45—7:20. I advise that all people filing complaints or attempting to appeal a charge do it through chat—and cut-and-page frequently during the chat—to have a record of your interactions with customer service.

I was going to keep the names of the representatives (which aren’t real, anyway) in this transcription, but changed my mind as I had told the guy, at the end, that I wouldn’t, and so am keeping my word.

Current Transcript of the Chat Session

Thank you for choosing Bank of America. You are now being connected to a Bank of America Online Banking Specialist.

E: Hello! Thank you for being a valued Bank of America customer! My name is E.

E: May I please have your complete name and last four digits of your account?

You: Brian Stefans—

You: ****

E: Thank you, Brian.

E: Welcome to Online Chat. How are you doing today?

You: Ok, but my account is -$277.

E: I understand your concern regarding the overdrawn account.

You: What can I do to reverse some of these charges. I don’t have enough cash to bring the account into a positive balance, which means I will start to accrue more penalties over the next week.

E: I do realize that you wish to refund some of the fees.

E: I will certainly check that for you right away.

E: Please give me a moment while I check the details for you.

You: Ok.

E: As you are our valued customer and do not want you to have bad experience with us as your satisfaction is of high priority for me!

E: I am able to refund you with fee of $35.00.

E: Please do trust me as I need to go beyond my limitations to get this refund for you.

E: Would you like me to process this for you?

You: That really won’t help much. Why do you need to go beyond your limitations? What are your limitations? [endnote 35]

E: I would like to let you know that we will be able to refund the fees only if it is a bank error.

E: As it is not a bank error, we are unable to refund fees.

You: This is my story. I am a teacher with a research fund, but the way that it works is that I purchase things with my own cash and get reimbursed about a week later. However, because of the holiday, they didn’t process my purchases, and after the holidays ended, they had a backlog which held the check up further. Meanwhile, I have a roommate (actually, my sister) who has been out of work for several months. For some reason unemployment decided not to send her a check this month (she has an appointment to speak with them on the 13th). But this would have all been fine except that a check I paid through Bill Pay—I pay everything through Bill Pay—wasn’t presented until two weeks later.

E: Please give me a moment while I go through the message.

You: I would have been fine—I had $70 dollars in the bank through the weekend until the reimbursement came in—but the check was presented and as a result I got 4 overdraft fees on the same day, and then another 2 the next day, all for things that were very inexpensive. Because I knew I didn’t have money, I bought a lot of small things instead of just getting a large number of things, hoping that would keep me afloat. I checked the website obsessively to be sure that I was within a safe range—something like 3-4 times a day—but I still got stuck with this.

You: I could have borrowed money once I learned the reimbursement would be late, but of course, it was pointless after I got in the hole. I have since borrowed some cash, but only so that I could buy groceries. I can’t even put it in the bank.

E: I completely understand your concern in this regard.

You: Of course.

E: But, I am sorry I am unable to refund all the fees for you.

E: I am able to refund only $35.00.

E: Trust me, this is the best that I can do for you at this moment.

You: Well then what happens? I can’t pay the balance. I’ve been a customer with your bank for nearly 15 years.

E: I really appreciate your relationship with us.

E: That is the reason, I am going ahead and providing with the $35.00 refund.

You: My credit rating is perfect—doesn’t this count for anything?

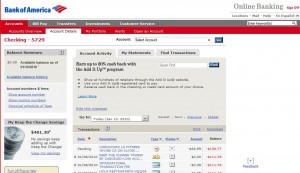

You: I teach computer interface and design, and I’m really very good with computers. Is there any place on the website where I can find good tutorials about the site? I made this mistake because I didn’t know where to look for checks that hadn’t been presented. It doesn’t appear on the Accounts Detail page.

E: I really wish I could but the credit rating will not come in count.

E: I personally apologize for the inconvenience caused to you.

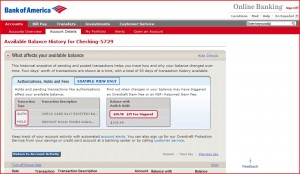

You: I had a problem a few months ago because I didn’t know that holds appeared on the Available Balance History page and not the Accounts Detail page.

E: Would you like me to refund $35.00?

You: Yes, but could you at least help me with the site?

You: I don’t have any place to turn.

E: May I know which site you are referring to?

You: The Bank of America Online Banking Center.

E: Sure.

E: Online Banking [endnote 36]

E: Please click on the above link to know more about the online banking.

E: Is there anything else that I may assist you right now?

You: Yes, can you tell me what the Clarity Statement is? I came upon it recently.

You: I’ve seen the page you linked to, but it doesn’t explain the difference between the Accounts Detail page and the Available Balance History page, which I need to know.

E: Okay. I will let you know about the difference between both of them.

E: Please keep the following information in mind when reviewing your account balances.

You: Sure [endnote 37].

E: The first balance you notice is the available balance on the Accounts Overview screen.

E: This balance can be updated during a business day with normal electronic or branch transactions.

E: The available balance is the same information that appears on your ATM balance inquiry receipt.

E: Your available balance will also be displayed on the Bill Pay Overview screen in the Pay From drop-down box located on each payee.

E: A running balance for each item processed and the end-of-day ledger balance is shown on Account Activity sub-tab, on the Account Details page.

E: The ledger balance is all cash, checks and other items deposited to your account, minus all withdrawals and checks paid against the account.

E: The ledger balance does not include any transactions outstanding that have not yet been presented to the bank.

E: The ledger balance shown is current as of the previous business day.

E: Please note that the Account Details page will show both your available balance and your ledger balance.

E: The available balance is located on the top left of the screen.

E: The ledger balance is shown on the Account Activity sub-tab.

You: Ok. But how come holds don’t appear there?

You: If I can get penalized for holds, they should appear there, right?

E: When you make the debit card transactions it will show in pending status.

E: You need to make a note of the authorization holds.

You: Yes, but holds are a different matter. And you never know how much you are being held for.

You: Restaurants and bars don’t tell you this.

E: But you will know the amount that you spend right?

You: Yes, but that’s not what they hold you for. They often hold you for much more until they process the transaction. Meanwhile, you are held responsible for it by the bank.

You: And, again, that figure doesn’t appear in the Available Balance.

E: Typically, a transaction made with a check card or ATM Card using a PIN is processed and posted to your account on the same day that the transaction is made, or on the next business day.

E: When a check card transaction is made, the merchant requests the bank to authorize the transaction. If the bank does authorize the transaction, the bank becomes obligated to pay that amount to the merchant.

E: Usually, a transaction made with a check card will appear as authorized on the day it is conducted, but may take one to three business days to post.

You: So are you saying I should write down every transaction that I make?

E: Yes, you need to just make a note of it.

You: Everything, bottles of coke, hamburgers, etc?

E: Then it would be easier for you to use the funds.

E: Or.

E: You can set up for the alerts.

E: So whenever you make the transactions, you will receive the notice.

E: So that you cannot overdraw your account.

You: Yes, but the alerts only tell you when your balance reaches a certain point. I check the website all the time.

You: I won’t get an alert about a hold.

You: The alerts are linked to your available balance, which doesn’t account for holds.

E: I do realize your situation.

E: I will be glad to forward this suggestion to our respective department.

E: They will surely able to look in to this.

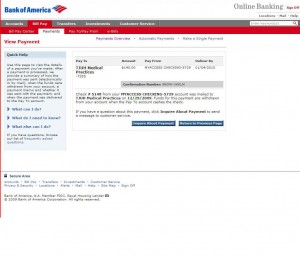

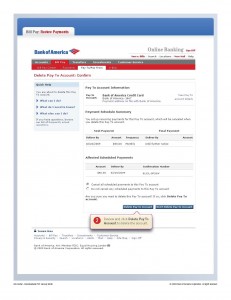

You: Also, I don’t understand why checks that have been paid through online Bill Pay, but which haven’t been presented, don’t appear as “pending†in Available Balance. Why is this?

You: If you pay all of your bills through site, as I do, and which BoA encourages, you would think that they would help you keep track of the ones that haven’t come in. I pay 15 bills through bill pay on average, which makes it hard to see what has already come in.

You: I.e. been presented.

You: How do I keep track of that?

You: Still there?

E: Yes.

E: I understand that you wish to keep all the track for all the bill payments, am I correct?

You: Yes, including those which don’t get presented right away. I was told by customer service that checks were sent out early so that they would be presented on the pay-by date, but this doesn’t seem to be true.

E: Online banking allows you to view the payments made last 180 days.

You: Yes, but where do I find information about checks that have been sent or “processed†but not presented?

E: You mean cancelled checks?

You: No, those checks that I paid through Bill Pay but which have not been deducted from my account.

You: Checks that I’ve sent appear in the left column on the day they are sent, then disappear. Most of them are deducted right away, but occasionally one is not deducted for a few weeks. They are hard to keep track of, and I can’t find anywhere on the site that just lets me know what they are.

E: Unless the bill payment posts to your account, you can view the cancelled bill pay.

E: Is there anything else that I may assist you right now?

You: Yes, can you tell me what the Clarity Statement is?

You: I really appreciate your help. I just don’t know where else to get this info from.

You: I figure with chat you can look these things up.

E: May I know from where you come to know about the Clarity Statement?

You: From the website, trying to find answers to these questions.

E: Please be rest assured that there is no such statement.

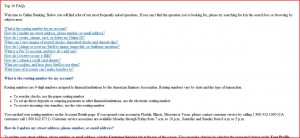

You: Ok. Sorry for all the questions. Could you explain to me the Extended Fees? When do they start, and how much are they?

E: Sure.

E: Extended overdrawn balance fees is the charge of $35.00 will be assessed to your account, if your account was overdrawn and if there was no deposit for the next 5 business days, then your account will be charged with Extended overdrawn balance fees [endnote 38].

You: How often?

E: Whenever the account was overdrawn.

You: No, I mean how often will I be charged an additional $35?

You: I don’t think I can pay back the bank within the week, or maybe even two weeks.

You: Is there a webpage that explains this?

E: Only one time.

You: Oh, so I’ll get an additional charge of $35 despite all of the overdrafts just once?

You: Sorry to pester you, but I’m in a bad situation.

E: Fees [endnote 39].

E: Please click on the above link.

You: Thanks, I’ll check.

E: You will get the details on all the fees.

E: Is there anything else that I may assist you right now?

You: Ok, a few more questions. What about My Portfolio. Would that help me?

You: Do holds, pending checks, etc. appear there?

You: Really sorry. I just need to know.

E: Not a problem [endnote 40].

E: My Portfolio gives you the ability to consolidate and manage all of your online accounts in one place, with a single ID and Passcode.

E: It provides a comprehensive view of all your accounts and balances across multiple financial institutions, and even allows you to consolidate non-financial accounts, such as frequent flyer programs and e-mail accounts.

E: No enrollment needed.

E: While signed into Online Banking, just click My Portfolio tab located on the Accounts tab.

E: Remember to always look for your SiteKey before you sign-in to Online Banking.

E: Bank of America accounts linked to your Online ID will be immediately available.

E: You can choose to add more accounts at any time.

E: To set up more accounts in My Portfolio, you will need your sign-in information, including user names and passwords, for each of the online accounts you want to view.

You: But what about holds and pending check?

E: I am sorry the authorization holds you cannot view it online [endnote 41].

E: However, if it is a deposit hold you will be able to get the details of the hold when ever you deposit the funds at the teller.

You: Ok. Thanks. One thing I discovered was the “Info Center.†What is that?

E: Info center is the one where you will get more information with pictorial representation.

You: Will it answer these questions?

E: You can just go through it, you will get more information.

E: However, if it is with regards to the fees, you can go through the link which I provided as Fees.

You: Ok, thanks. One last question. Can you tell me why exactly BoA charges overdraft fees? Is it a punishment, or is there some cost to the bank?

You: Where do these fees go?

E: An Overdraft item occurs when we pay your check or other transaction even though you do not have enough available funds in your account to cover the given transaction. In this case, we pay the transaction and charge you an Overdraft Item fee for each item.

You: So I buy something for one dollar and I get an overcharge fee for $35. I don’t quite understand.

You: But I know that’s what happens.

You: Lastly, who can I write to for more information about this? Or to appeal. Do you have an email address or phone number?

E: Yes, I do realize your situation.

E: Please let me know if you have any more queries, I will be glad to assist you?

You: I’d like an email address for someone else I can write to.

You: Or mailing address.

E: I request you to send us an e-mail by clicking on customer service tab then after that on left hand side there is a option send us a mail.

You: Yes, but that will just go to people like you who can’t do much because of your limitations. Is there anyone else?

E: Here me and my supervisor.

E: If you wish I can transfer this chat to him.

E: May I?

You: Sure, but show him this stuff so I don’t have to repeat myself.

You: Have a nice day, sorry to be a pain.

E: The chat will be encrypted.

E: You need not repeat the whole thing.

E: No worries!

You: Oh, ok.

E: Please give me a moment while I transfer this chat.

You: Sure.

You: You take care!

E: Thank you. You too.

Please wait while I transfer the chat to A. who can best assist you today.

Thank you for choosing Bank of America. You are now being connected to a Bank of America Online Banking Specialist.

A: Hello, I am A., the floor supervisor.

A: Please give me a moment while I go through the previous conversation.

You: Great, thanks!

A: Thank you.

A: Thank you for your patience.

You: Cool, no problem.

A: I understand that you are concerned about the overdraft fees.

A: Is that correct?

You: Yes. As you can see, I’ve asked several questions: about the difference between the Available Balance History and the Account Activity page, about where checks that have been paid through Bill Pay that have not been presented, about the Clarity Statement and its purpose, about the lack of really good tutorials on the site (the Info Center tutorials are really bad), etc.

You: I really want to know how to use this site, because I’ve had overdraft problems in the past, and they’ve mostly been for very different reasons: holds, checks, trying to change the amount of a bill pay and not being able to, etc.

You: Also about My Portfolio—can this help me put this all together?

A: Brian, I have reviewed your account and I see that the fees have been assessed correctly.

You: Yes, I know. I want information about the website.

A: However, I will be able to refund only one $35.00 fee as a courtesy.

A: Sure, please go ahead.

You: With what?

A: I understand that you would like to know about our Online Banking. Is that correct?

You: Yes, of course. Do you know what the Clarity Statement is?

A: Can you be more specific about the clarity statement?

You: You should probably Google it. It’s there. I think it was released in September.

You: It has a line about how all Bank of American customers should record ALL of their transactions in a check register. I discovered it when I was trying to find out why I was having all of these problems. I check the online center obsessively.

A: I would request you to contact us at 1.800.622.8731[Customer Service number for Checking and Savings] regarding the clarity statement.

You: What number is that?

A: The associates at the above mentioned number will help you with information about the clarity statement.

A: Our specialists are available between 7:00 a.m. and 10:00 p.m. Monday through Friday; 8:00 a.m. and 5:00 p.m. Saturday, Pacific Time.

You: Is there anyone more senior that I can write to about this? I’d like to write a formal letter to someone higher up in the company.

You: Here’s the Clarity Statement: https://www1.bankofamerica.com/deposits/odao/popup/disclosure_popup.cfm?template=sofCA&RequestTimeout=300

You: Here’s a story about it:

You: http://www.creditnet.com/credit-news/boa-offers-clarity-statement-for-credit-cards-19489771.php

You: Still there?

You: Sorry to be a pain.

A: Yes I am with you.

A: Brian, could you also let me know how I may help you with your concerns regarding My Portfolio?

You: I just want to know if it’s a place where all of my holds, pending checks and other data that seems spread out across your site can be found. But I’m more interested in the Clarity Statement, since it seems to have some purpose.

A: Let me explain My Portfolio.

You: Ok.

You: But only if it can help me in this situation.

You: I’ve cancelled all of my credit cards. I’m a web designer so I know about these things. But I get fouled up with this site in a hundred different ways.

A: My Portfolio is a feature that allows you to view your accounts with different financial institutions at one place [endnote 42].

You: I don’t deal with other financial institutions.

A: Okay.

You: Well, I guess I have all of the answers I need. You don’t know anything about the Clarity Statement, you can’t answer questions about the different screens on the site and where I can find detailed answers about them, you’ve never heard of the “Info Center,†you won’t provide me with a name or email address where I can lodge a complaint (this appears readily on the web), you can’t explain the logic behind overdraft fees, you haven’t referred me to any of the FAQs on the site (which are really poorly constructed), and you are not able to provide a customer of over 15 years with more than a $35 refund. Fine. This is all going into my report.

A: I will help you with the information about the various screens.

A: Please give me a moment.

You: No, too late. The site is really incredibly complicated, and if a person has to conduct a chat session for an hour and a half—a web designer and computer programmer, no less—then I’m not sure what you can do! Sorry to be a pain, but I’ve just written a thirty page analysis of your site which I will distribute to journalists, activist sites, etc. and this chat session (I won’t include your name) will be in it.

A: I personally apologize for any inconvenience caused to you in this regard.

You: Sounds good. Have a great night.

Note:

This post is a section of Bank of America Online Banking: A Critical Evaluation. This essay is also available as a book which can be downloaded for free at Lulu (where an inexpensive, not-priced-for-profit print edition can also be purchased) and at Scribd. The table of contents for the blog version of this essay can be seen in its entirety here.